As the volume of variable renewable energy (VRE) sources penetrating electricity grids increases globally, so does the need to manage the increasing uncertainty and variability in electricity supply.

Long duration energy storage (LDES) technologies will be key in supporting electricity grids with greater penetrations of VRE over the coming decades. However, while many of the LDES technologies are likely to be cheaper than Li-ion batteries, on a US$/kWh basis at longer durations of storage, they will need to generate revenues from multiple sources in order to be profitable.

Multiple opportunities to generate revenues from LDES assets do exist, though to improve investor confidence and to strengthen the economic case for these technologies, longer and larger electricity price arbitrage opportunities and changes to remuneration mechanisms for other services will be needed.

This article draws insights from IDTechEx’s market report, “Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts”.

How can LDES technologies generate revenues?

There are three key sources of revenues that can be generated from owning and using LDES technologies, stemming from price arbitrage, capacity market (CM) (or resource adequacy (RA)) contracts, and ancillary service provision.

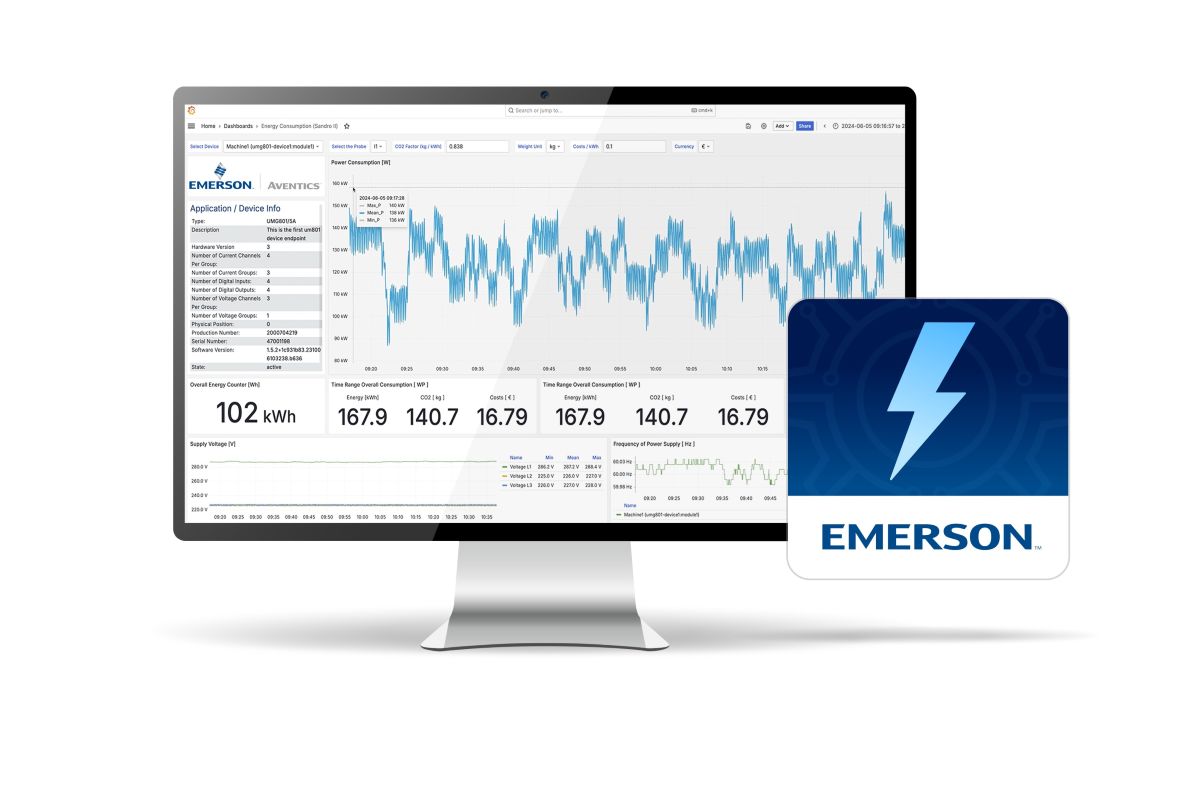

These technologies will be used at grid-scale to store and dispatch energy from VRE over longer timeframes. Therefore firstly, asset owners will look to charge these systems when electricity prices are higher, and discharge when they are lower, taking advantage of price arbitrage.

Secondly, asset owners can win capacity market contracts. The capacity market is a mechanism used to ensure that there is a reliable and secure supply of electricity generation capacity available to meet electricity demand. It is designed to address the intermittency and unpredictability of VRE power generation, and times when the electricity system is stressed, e.g., by cold snaps.

The capacity market provides a financial incentive for power generators to maintain or increase their capacity, thus ensuring grid reliability. The capacity market allows existing and new-build generators to compete for contracts at auction, which (at least in the UK) can vary from 1 to 15 years. Payments are made to generators not for the electricity they deliver but for the availability to provide capacity at times of peak demand.

New build generators can win 15-year contracts in the T-4 Auction in the UK, which provides longer-term revenue and investment security. Therefore, the capacity market is a key driver for investment into new LDES assets that can provide dispatchable power.

Thirdly, LDES technologies could be used to provide ancillary services for the grid, e.g., voltage support, frequency restoration and reserve, black start, etc, to maintain grid reliability. Asset owners are remunerated by transmission system operators (TSO) for the provision of these services. Energy storage systems could also provide multiple services while taking advantage of price arbitrage, allowing asset owners to stack revenues and maximize profitability.

What are the challenges with revenue generation from LDES?

As suggested in IDTechEx’s market report, while there are multiple opportunities for LDES asset owners to generate revenues, there are some challenges that weaken the economic case for these systems. Firstly, price arbitrage opportunities are currently not frequent, long, or large enough to make a strong economic case alone for LDES technologies.

Therefore, generating greater revenues from price arbitrage is dependent on the growing penetration of VRE. While CM contracts are likely to be a key source of high-volume and long-term revenues for owners, they could be redesigned to not only ensure the security of supply but also to value the other benefits of storage, such as its contribution to electricity price reduction, support for renewable growth, and provision of system services.

Most ancillary services could easily be provided by a 2-hour duration of storage system, such as existing Li-ion battery energy storage systems (BESS). Therefore, LDES asset owners will be in direct competition with owners of these shorter-duration Li-ion systems for the provision of many ancillary services.

Moreover, the current market structure does not always fully remunerate the range of services certain ES technologies can provide. For example, a mechanical ES system could be scheduled to provide voltage support but will also provide grid inertia as a consequence of heavy spinning masses in the system. If this project had won a contract for providing voltage support but not grid inertia, and these services cannot be separated, the ES asset owner would not be fully remunerated for the provision of both services.

Also, these contracts are typically provided over day-to-month timeframes. Therefore, it is difficult for an asset owner to assess, early on in project development, which ancillary services they will be remunerated for. Further challenges related to generating revenues from LDES technologies can be found in more detail in IDTechEx’s new market report.

Outlook for revenue generation from LDES

Ultimately, there is generally a need for long duration energy storage systems to have longer-term revenue visibility, which is important for making investments in new systems, while also proposing to reduce the payback period for these assets, thus strengthening the economic case for LDES systems.

As LDES systems could be deployed at scales from 100 MWh to multiple GWh, the value of these systems will be in the range of US$100M-1B+ and require several years to develop. Providing large volumes of funding over a long development time increases the risk of investment, which could spur an increase in the cost of capital and thus re-emphasizes the need for longer-term revenue visibility.

Players in interviews with IDTechEx have generally called for regulators to make reforms to long-term CM or RA contracts and re-design remuneration mechanisms for the provision of multiple ancillary services to provide asset owners with greater volumes of revenue from these services.

Positively, however, price arbitrage opportunities will less-so be driven by electricity market regulation. As the volume of VRE penetration increases, this will create greater swings in electricity supply and thus create greater volatility in electricity prices, as well as more frequent and longer arbitrage opportunities. Therefore, price arbitrage is likely to be a growing contributor to revenue generation from LDES in the long term.

For more information on LDES technologies, players, applications, revenue streams, electricity markets, variable renewable energy (VRE) penetration, grid stability and flexibility, and granular 20-year market forecasts, please refer to IDTechEx’s market report, “Long Duration Energy Storage Market 2024-2044: Technologies, Players, Forecasts”.

To find out more about this report, including downloadable sample pages, please visit www.IDTechEx.com/LDES.